Gold seems to be enjoying a resurgence, or perhaps its battle with Bitcoin is hotting up. At any rate, LinkedIn seems to be awash with posts about ‘ethical gold production’ (if only). And Joe Brunner, an “affirmed systems CEO” (?), offered it his support, saying

We need a 1:1 Gold Backed Dollar. All the people doing nothing of value will get shaken out.

This is, of course, a pure Ayn-Rand-style fantasy. In Atlas Shrugged, Dagny Taggart was denied the purchase of a pack of cigarettes because she could not pay in gold. Her conversation with her former employee, Owen Kellogg, went like this:

He chuckled good-naturedly. “I can tell you this much: they’re made by a friend of mine, for sale, but—not being a common carrier —he sells them only to his friends.”

“Sell me that package, will you?”

“I don’t think you’ll be able to afford it, Miss Taggart, but—all right, if you wish.”

“How much is it?”

“Five cents.”

“Five cents?” she repeated, bewildered.

“Five cents—” he said, and added, “in gold.”

She stopped, staring at him. “In gold?”

“Yes, Miss Taggart.”

“Well, what’s your rate of exchange? How much is it in our normal money?”

“There is no rate of exchange, Miss Taggart. No amount of physical—or spiritual—currency, whose sole standard of value is the decree of Mr. Wesley Mouch, will buy these cigarettes.”

At the 5 cent price tag and with gold now at $US90 per gram, Dagny would have needed an almost invisible pinch of the stuff to get her smoke.. It is difficult to see how that would have worked in practice without a paper currency as well, but In principle, that is allowable, as long as it remains possible for anyone to take their paper money into a bank and exchange it on the spot for gold. However, although Ragnar Danneskjöld was been bringing the stuff into Galt’s Gulch by the overloaded plane-load, he was getting it in exchange for the fruits of his piratical forays. He did nothing to add to the global store, which is rather limited; a twenty-two meter cube representing the total of all the gold mined to date would undoubtedly seem impressive if placed in the middle of Trafalgar Square, but would not reach even half way up Nelson’s column. That does not strike one as something on which an entire global financial system could be based.

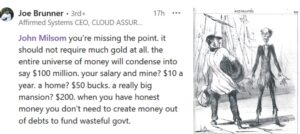

Now, I have been accused of misrepresenting Rand’s thoughts by taking Atlas Shrugged too literally as a guide to her ‘philosophy’, as It is, after all, a work of fiction. But Joe Brunner, it seems, takes it very seriously indeed. When I asked him how much gold would be needed, he replied as in Figure 1.

Figure 1. Left: The LinkedIn comment that prompted this blog. Right: A contemporary French cartoon of the California gold rush. The figure on the left is a hopeful arrival, the figure on the right shows how he would look a few months later. However, with gold at USD900,000 a gram, the positions would likely be reversed. But only very briefly,

So that is how it would work, and that ‘condensation’ is of course, required if system is going to run with ‘not much gold’ and there is going to be a 1:1 gold-backed dollar, because a 1:1 gold-backed dollar. With salaries of USD 10 per year, and decent housing costing USD 50, one of Joe Brunner’s dollars would have to do the work of about ten thousand of today’s US dollars. A gram of gold currently sells for $US 90 but under this system it would have to represent the value of some 900,000 of those same dollars. One gram of gold (roughly, a 7mm cube) would buy a couple of houses, but it would take the 10-dollar a year man nine years to earn that much.

I can see some problems with that

Gold is a commodity, It has a physical existence, it is produced. Like all commodities, there are costs involved in its production. If costs exceed the value of the product, production will cease rather quickly. In this case, however, the costs of production would be only a tiny fraction of the value produced; the world would become awash with producers, as It would not be worth anyone’s while to do anything else. There would be a gold rush such as the world has never seen. Forests would razed, mountains would be levelled and rivers and streams would be dammed and polluted. Cities would be denuded of their inhabitants as they all headed for the goldfields.

But, as in past gold rushes, miners need supplies. Are the suppliers going be content with receiving pittances while the prospectors are making their fortunes? Of course not. Inflation would skyrocket, first at the goldfields and then elsewhere. On a more global scale, states rich in oil would demand high prices for their ‘liquid gold’ from states lacking oil but rich in the solid sort of gold. And they would, of course, demand those same prices from all their other customers.

In the end, and at the cost of enormous environmental destruction, mankind would have to face the truth of the old saying,

You cannot eat gold.